Some Known Details About Guided Wealth Management

Some Known Details About Guided Wealth Management

Blog Article

A Biased View of Guided Wealth Management

Table of ContentsThe 8-Minute Rule for Guided Wealth ManagementSome Ideas on Guided Wealth Management You Should KnowThe Only Guide to Guided Wealth ManagementThe Ultimate Guide To Guided Wealth ManagementGetting My Guided Wealth Management To Work

Be alert for possible disputes of interest. The advisor will establish a possession appropriation that fits both your threat tolerance and danger capacity. Asset allotment is simply a rubric to identify what percentage of your complete financial portfolio will be dispersed throughout different property classes. An even more risk-averse person will have a better focus of federal government bonds, deposit slips (CDs), and cash market holdings, while a person that is even more comfortable with threat may decide to tackle even more stocks, corporate bonds, and perhaps also financial investment realty.

The typical base pay of an economic expert, according to Certainly since June 2024. Note this does not consist of an estimated $17,800 of annual commission. Any individual can deal with a monetary advisor at any type of age and at any phase of life. superannuation advice brisbane. You do not have to have a high internet well worth; you just need to locate an advisor suited to your circumstance.

10 Simple Techniques For Guided Wealth Management

If you can not manage such aid, the Financial Preparation Association may have the ability to aid with pro bono volunteer aid. Financial experts help the client, not the business that utilizes them. They ought to be responsive, going to describe monetary concepts, and maintain the customer's benefit in mind. If not, you must seek a brand-new advisor.

A consultant can recommend feasible enhancements to your strategy that may aid you achieve your objectives better. If you do not have the time or interest to handle your finances, that's an additional good reason to work with an economic consultant. Those are some basic reasons you could need an expert's expert assistance.

An excellent financial advisor should not just sell their services, yet give you with the devices and sources to come to be monetarily savvy and independent, so you can make educated decisions on your own. You want an expert that remains on top of the monetary range and updates in any type of area and that can address your monetary inquiries about a myriad of subjects.

Getting The Guided Wealth Management To Work

Others, such as licensed economic planners(CFPs), already stuck to this requirement. Under the suitability requirement, financial advisors commonly work on commission for the items they sell to customers.

Some advisors might use reduced prices to help clients who are just obtaining started with monetary preparation and can't pay for a high month-to-month rate. Normally, an economic expert will offer a totally free, preliminary assessment.

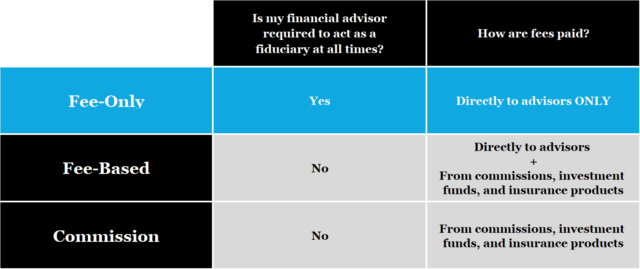

A fee-based monetary advisor is not the very same as a fee-only economic advisor. A fee-based consultant may earn a cost for creating a monetary plan for you, while additionally gaining a compensation for selling you a certain insurance coverage product or financial investment. A fee-only financial advisor earns no payments. The Stocks and Exchange Payment (SEC) proposed its very own fiduciary regulation called Policy Benefit in April 2018.

The Guided Wealth Management PDFs

Robo-advisors do not require you to have much money to start, and they set you back much less than human monetary advisors. Instances include Improvement and Wealthfront. These services can save you time and possibly cash as well. A robo-advisor can not speak with you concerning the ideal way to obtain out of debt or fund your kid's education and learning.

An expert can help you figure out your cost savings, exactly how to construct for retired life, aid with estate planning, and others. Financial consultants can be paid in a number of means.

An Unbiased View of Guided Wealth Management

Marital relationship, separation, remarriage or simply relocating with a new partner are all landmarks that can call for mindful preparation. For circumstances, together with the often difficult psychological ups and downs of separation, both partners will have to handle crucial monetary factors to consider (https://guided-wealth-management.jimdosite.com/). Will you have adequate earnings to sustain your way of life? How will your investments and various other possessions be separated? You might quite possibly require to change your economic approach to maintain your goals on course, Lawrence states.

An abrupt influx of cash money or possessions elevates immediate questions regarding what to do with it. "An economic advisor can assist you assume via the ways you might place that cash to function towards your personal and monetary objectives," Lawrence says. You'll intend to consider just how much could most likely to paying down existing financial obligation and just how much you could take into consideration spending to pursue a more safe future.

Report this page